Singapore: Oil prices firmed slightly early on Tuesday, after falling 2 per cent in the previous session, as stronger economic data from the world's largest crude importer China underpinned demand outlook.

Brent crude climbed 23 cents to $84.99 a barrel at 0416 GMT, while US West Texas Intermediate rose 21 cents at $81.04 a barrel.

China's economy grew faster in the first quarter, official data showed, expanding 4.5 per cent year-on-year as policymakers move to bolster growth following the end of strict COVID-19 curbs in December, according to Reuters.

"The remarkable recovery of the Chinese economy has supported the recent rebound in oil prices," CMC Markets analyst Leon Li said.

Furthermore, May is the seasonal peak travel period in China and demand for fuel is expected to post a very large year-on-year increase, he added.

Chinese refinery throughput surged to record levels in March, signalling robust demand for the fuel, as refiners stepped up runs to capture strong export demand and build up inventories ahead of planned maintenance.

The International Energy Agency (IEA) has forecast that China will account for most of 2023 crude oil demand growth.

Oil prices also remain under pressure due to a stronger dollar and rise in treasury yields, National Australia bank analysts said in a client note.

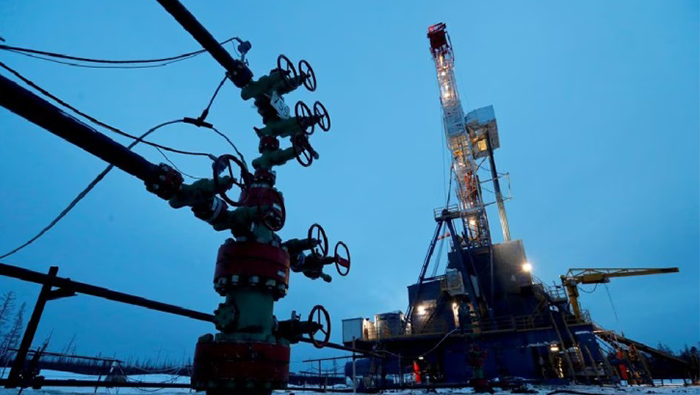

US crude oil and natural gas production in the seven biggest shale basins is expected to rise in May to the highest on record, data from the Energy Information Administration showed on Monday, signalling some supply increment on this front.

"The oil market will soon have to deal with recession fears but for now it should be a choppy trade," OANDA senior market analyst Edward Moya said in a client note.